stamp tax imposed

The Revenue Act of 1764 did not bring in enough money to help pay the cost of defending the colonies. The British looked for additional sources of taxation. Prime Minister Grenville supported the imposition of the a stamp tax. Colonial representatives tried to convince Grenville that the tax was a bad idea. Grenville insisted in having the new taxes imposed and presented them for approval to the parliament. The parliament approved the tax in March 1765

The stamp tax was a tax that was imposed on every document or newspaper printed or used in the colonies. The taxes ranged from one shilling a newspaper to ten pounds for a lawyers license, Everything a colonist needed to was taxed. The income was to be directed to pay the cost of defending the colonies.The colonist particularly objected to the fact that violation of the taxes would be prosecuted by in Admiralty Courts and not by jury trials. The tax was approved with no debate,.

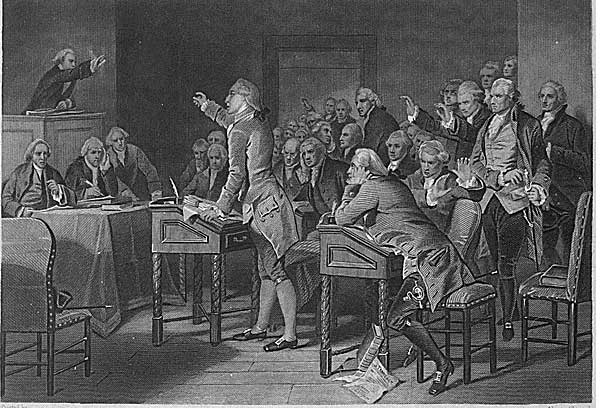

The colonies responded with outrage. It was considered a shocking act. The colonist considered the act unconstitutional, a tax had been imposed and they had not been consulted. They had no need to heed the taxes. The Virginia House of Burgesses was nearing the end of its session when word of the Stamp Act reached it. A young delegate named Patrick Henry introduced a Resolution which stated that: That the general assembly of the colony, together with his majesty or his substitute have in their representative capacity the only exclusive right and power to levy taxes and impositions on the inhabitants of this colony and that every attempt to vest such a power in any person or persons whatsoever other than the general assembly aforesaid is illegal, unconstitutional, and unjust, and has a manifest tendency to destroy British, as well as American freedom. This was the beginning of a united colonial opposition to the British Act. full text

>

>