Lehman Brothers Declares Bankruptcy

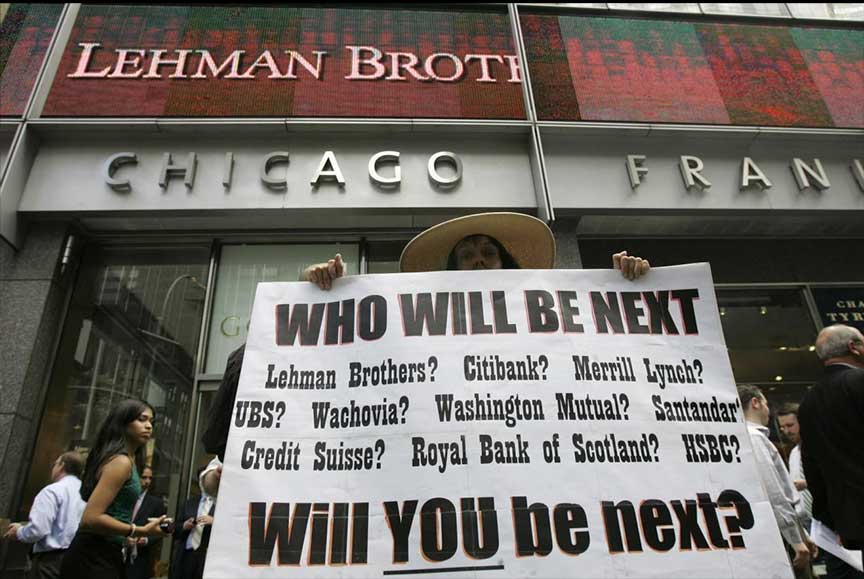

Lehman Brothers in Chicago

On September 15, 2008, Lehman Brothers declared bankruptcy. It was the largest bankruptcy in US history. The filing by Lehman was not the cause of the financial crisis, but the bankruptcy turned the financial problem into a full-fledged crisis.

The seeds of the financial crisis were the rapidly increasing house prices in the United States throughout the first years of the century. More and more people were buying homes, and the banks came up with new ways of lending them money. Providing a mortgage with no money down became a norm. This was fine as long as house prices were rising. When they stopped rising, that became a significant problem.

Traditionally mortgages were issued by local banks who knew their clients and knew the value of real estate in their markets. However, in the years leading up to the crisis new lenders including Lehman entered the market- especially in what was called subprime- meaning borrowers who might otherwise not qualified for a loan. The new lenders created a new method of financing these loans by creating back mortgage securities and collateralized debt obligations (CDO). These were packages of mortgages at different values that were then resold as you would a stock or bond.

Housing prices had peaked in 2006 and began going down in 2007. As a result, homeowners were finding it more and more difficult to refinance their homes. As a result, more an more homeowners began to default. Because of the defaults and the rapidly dropping value of the price of homes the value of the CDO’s started to fall, even worse it was not clear what their values were.

Lehman Brothers was particularly vulnerable to the drop in the value of homes and the mortgage-backed securities. The company had borrowed heavily to invest in the mortgage market. Lehman reported ever-growing losses due to the drop in the value of real estate. In the second quarter of 2008, the company reported losses of $2.8 billion and Lehman was having a harder time of borrowing, and Lehman shares plunged. Lehman announced on September 10th an additional loss of $3.9 Billion. On September 12, 2008, the New York Fed met to find a way to save the bank. An attempt to arrange the sale of Lehman to Barclays or Bank of America failed, and finally, the decision was taken that there was no choice but to declare bankruptcy.

The bankruptcy of Lehman pushed the stock markets into a tailspin with the Dow Jones Industrial dropping 500 points the next day. AIG and other funds suffered runs on their funds. The Federal Reserve stepped in to try to stabilize the markets and were ultimately successful in stopping a complete collapse of the financial system.

>

>