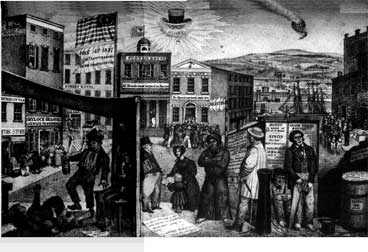

1837- Panic of 1837

The Jackson years were years of rapid economic expansion in the United States. The expansion was driven by cheap credit, together with rising prices for cotton and land. As prices (especially for land) continued to rise, there was fear that speculators were creating a "land bubble". President Jackson pressed the Congress to pass the Specie Act (an act that required land to be paid for with coinage and not paper money) in order to fight the speculators. The Specie Act had the unattended consequence of draining much of the money from large banks. This made the banks more susceptible to a bank run, where people demanded their money back...

The Jackson years were marked by rapid economic expansion in the United States. This growth was driven by cheap credit and rising prices for cotton and land. As prices, especially for land, continued to rise, there were fears that speculators were creating a "land bubble." To combat these speculators, President Jackson pressed Congress to pass the Specie Act, which required land to be paid for with coinage rather than paper money. However, the Specie Act had the unintended consequence of draining much of the money from large banks, making them more susceptible to bank runs, where people demanded their money back.

The land bubble burst when the Bank of England tried to stem the outflow of money by raising interest rates. Even in the 1830s, the global economy was interconnected, and banks in the U.S. were soon forced to raise their interest rates as well. This rise in interest rates coincided with a drop in cotton prices on the world markets. The drop in cotton prices forced one of the main cotton brokers in New Orleans to go under. The collapse of the New Orleans cotton broker had a cascading effect on the economy, as the broker's creditors soon found themselves unable to pay their bills. Shortly after, weakened banks in New York were in trouble and suspended their redemption of paper money for coinage.

At this point, the economic panic was in full swing. Banks failed, and factories laid off workers either because they could not get credit or because customers were unwilling to place orders. The U.S. faced a full-fledged depression. Moreover, due to Jackson's insistence on closing the Bank of the United States, there were no tools to fight the depression. President Van Buren took a hands-off approach to the problem, believing it was not the government's responsibility to combat economic hard times. As a result, Van Buren's popularity plummeted. It took several years for the economy to recover. However, by then, one of President Jackson's proudest accomplishments—paying off the national debt—lay shattered. Jackson had successfully paid off the debt, but as tax revenue plummeted due to the depression, Van Buren was forced to borrow money to cover national expenditures.

>

>